A recent media headline marveled at how far TFSAs have come and how they are catching up to RRSPs as a preferred investment vehicle for Canadians. Often however, this choice is made at the expense of contributions to an RRSP.

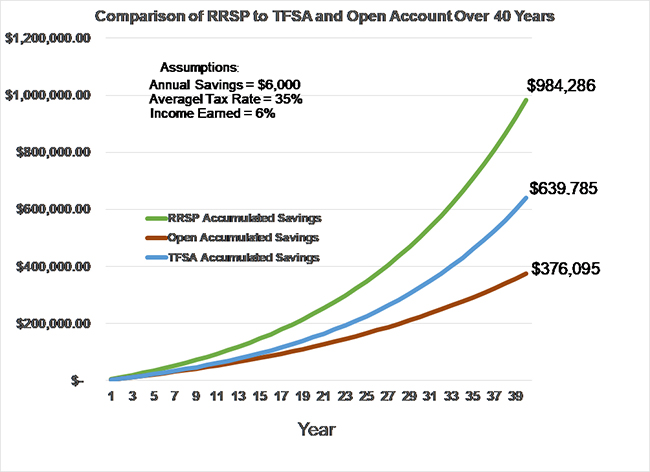

With the RRSP contribution deadline fast approaching on March 2nd, it is time to take a look at the benefits of using an RRSP, even for many modest income earning Canadians. If you compare the full RRSP amounts invested versus the net after tax amounts going into a TFSA and then allow the invested amounts to compound on a tax-free basis over time, the RRSP will grow to a larger capital base over longer 30-40 year time periods.

There are two reasons for this, more money is going to work from Day One in an RRSP, than the equivalent TFSA after tax contribution amount. The second reason is you are compounding more capital in your RRSP than you are using a TFSA with the same equivalent pre-tax dollars. A final benefit for an RRSP is that far more money can be contributed to an RRSP with a 2019 limit of $26,500 versus $6,000 for a TFSA. But even if we use the same $6,000 contribution limit for both RRSPs and TFSAs the RRSP will win out over time.

Some argue that the tax due on RRSP withdrawals makes them less favourable to a TFSA where all withdrawals are always tax-free. While this is a fair point, RRSPs - when converted to a pension - are never intended to be fully cashed out all at once.

For example, using a 4% return assumption, and a 15% retirement average tax rate (ATR), the RRSP will generate income of $39,372 or $33,465 net of tax. The TFSA will generate net income at 4% of $25,592.**

Finally, while some commentators will point to the taxability of RRSP income withdrawals (usually from a RRIF) and no tax on withdrawals from a TFSA, one could speculate that there may come a day when TFSA are taxed in some way as revenue hungry Governments eye the large capital values of TFSA accounts.

Let’s use some math here with the understanding that the amount of capital (savings) committed to both scenarios is still $6,000:

Scenario A) @15% average tax rate (ATR) is $6,000 minus tax of $900 or $5,100 net of tax

Invested capital is $5,100

Amount available for tax-free compounding is $5,100.

Scenario B) @25% ATR is $6,000 minus tax of $1,500 or $4,500 net of tax.

Invested capital is $4,500

Amount available for tax-free compounding is $4,500.

Scenario C) *@53% ATR is $6,000 minus tax of $3,180 or $2,820 net of tax.

Invested capital is $2,820

Amount available for tax-free compounding is $2,820

.

For this RRSP season please consider maximizing your RRSP contribution room first, if you have an income that is higher than say $40,000, before contributing to a TFSA.

Call us today to discuss your personal situation and to see which makes more sense for your situation!

*This is the top marginal tax rate in Ontario and for some taxpayers with high enough incomes it becomes their Average Tax Rate.

** The objective is retirement income and the key assumption is that your income and income taxes will be lower than during your higher earning working years. Finally, the average Canadian, according to surveys and media reports ideally wants retirement income of about $50,000. We used the capital values from the graph.

Copyright © 2020 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.